The Single Strategy To Use For Nj Cash Buyers

The Single Strategy To Use For Nj Cash Buyers

Blog Article

Indicators on Nj Cash Buyers You Should Know

Table of ContentsNj Cash Buyers Things To Know Before You BuyA Biased View of Nj Cash BuyersOur Nj Cash Buyers StatementsAn Unbiased View of Nj Cash Buyers

By paying cash money, you miss out on out on this tax obligation advantage. Having a home outright can leave you with restricted liquid possessions readily available for emergency situations, unforeseen costs, or various other financial requirements. Right here are some compelling factors to take into consideration getting a home loan as opposed to paying cash for a house:: By taking out a home mortgage, you have the ability to utilize your investment and potentially attain higher returns.

As opposed to linking up a substantial amount of money in your home, you can keep those funds offered for various other investment opportunities - cash for homes companies.: By not placing all your offered cash into a single possession, you can preserve a much more varied investment portfolio. Portfolio diversification is an essential risk management strategy. Paying cash for a home provides various advantages, increasing the percent of all-cash real estate offers

(http://www.detroitbusinesscenter.com/real-estate/nj-cash-buyers)The cash purchase residence procedure involves binding a considerable portion of fluid properties, possibly limiting financial investment diversification. In contrast, getting a home loan permits leveraging investments, keeping liquidity, and possibly profiting from tax advantages. Whether getting a residence or mortgage, it is essential to count on a reliable actual estate platform such as Houzeo.

The Basic Principles Of Nj Cash Buyers

With thousands of residential or commercial property listings, is one of the biggest home detailing websites in the US. Yes, you can purchase a house with cash, which is much easier and useful than applying for home mortgages.

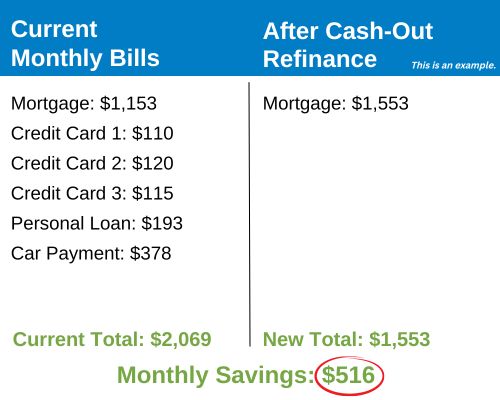

Paying money for a residence binds a huge quantity of your fluid assets, and limit your financial flexibility. Additionally, you miss out on tax advantages from home mortgage interest deductions and the opportunity to spend that cash somewhere else for possibly greater returns. Experts show that also if you have the cash money to buy a residential property, you must obtain a home mortgage for tax obligation exemptions and much better liquidity.

Now that we've gone over the need for cash offers in today's genuine estate market, allow's explore what they are, that makes them, and their benefits for buyers and vendors. Commonly, the purchaser has the complete sale amount in their bank account and purchases the house with a check or wire transfer.

However, all-cash sales are coming to be increasingly preferred, making up almost 40% of single-family home and condo sales in Q2 2024, according to property information business ATTOM. In 2023's vendor's market, several purchasers had the ability to win quotes and conserve cash on passion many thanks to cash offers. Cash money deals typically bring about a quicker closing procedure, which attracts vendors to accept such quotes.

Some Known Facts About Nj Cash Buyers.

Real estate investors might locate the purchase of rental residential or commercial properties with cash to be tempting. This approach supplies its share of benefits and disadvantages, we will certainly analyze them here to permit financiers to make an enlightened decision about which path is appropriate for them. Cash purchases of rental residential properties provide immediate equity without sustaining home mortgage payments, providing you immediate possession as well as financial adaptability for future financial investments and expenditures.

Cash purchasers have an edge when bargaining considering that sellers prefer to do service with those that can shut promptly without requiring backups to fund a purchase (we buy houses for cash new jersey). This could result in discount rates or favorable terms which boost productivity for an investment decision. Money customers do not require to bother with rates of interest fluctuations and the feasible repossession threats that come with leveraged financial investments, making cash purchases feel more secure during economic recessions

The Main Principles Of Nj Cash Buyers

By paying cash money for a rental home purchase, you are securing away resources that might otherwise have been deployed somewhere else and produced higher returns. Acquiring with such big amounts limitations liquidity and diversification along with prevents general portfolio development. Cash money buyers often forget the advantages of making use of other individuals's funds as mortgages to increase financial investment returns tremendously faster, which can postpone wealth buildup greatly without leveraged financial investments.

Money buyers may miss out on out on certain deductions that can harm general returns. An investment that includes allocating substantial amounts of money towards one residential property might posture concentration threat if its efficiency experiences or unexpected problems arise, providing higher security and resilience throughout your profile of homes or property classes.

There has always been an affordable benefit to making an all-cash deal, however when home mortgage rates are high, there's one more: Borrowing cash is pricey, and paying for the home in complete assists you prevent the month-to-month obligation of home mortgage repayments and rate of interest. Even more individuals have actually taken this path in recent times, with the percentage of purchasers using a mortgage to buy a home falling from 87 percent in 2021 to 80 percent in 2023, according to the National Organization of Realtors' latest Profile of Home Buyers and Sellers. Naturally, most Americans don't have numerous thousands of dollars lying around waiting to be spent.

Even if you can manage to acquire a residence in money, should you? Is it a clever concept? Right here are the benefits and drawbacks. Yes, it is feasible and completely legal to purchase a home in full, equally as you would a smaller-ticket item like, say, a coat. This is described as an all-cash offer, even if you're not in fact paying in paper money.

Report this page